A power law relates one variable to another raised to a constant power. The general form takes y = xa, where y and x are variables, and a is a constant exponent.

A power law exhibits the property of scale invariance. When you multiply the Scale (x) with a factor b the function (y = baxa) does not change its Shape.

In 1817 Goethe wrote his book ”Zur Morphologie“. This book was the start of a new science called Morphology, the Science of the Shapes.

In his book Goethe describes the so called Uhrplant, the Primal Plant, which is based on the shape of the Leaf. Goethe believed that every Plant was a Leaf within a Leaf within a Leaf.

At the time of Goethe the concept of the fractal was not known. It was developed in 1975 by Benois Mandelbrot (“The Fractal Geometry of Nature”).

A fractal is a self-similar structure. It’s shape repeats itself on every level of expansion. Some fractals are scale-invariant.

The scale invariant fractal structure of the Leaf

About Kleiber’s Law

Metabolism is the process by which your body converts what you eat and drink into energy. During this complex biochemical process, calories in food and beverages are combined with oxygen to release the energy your body needs to function.

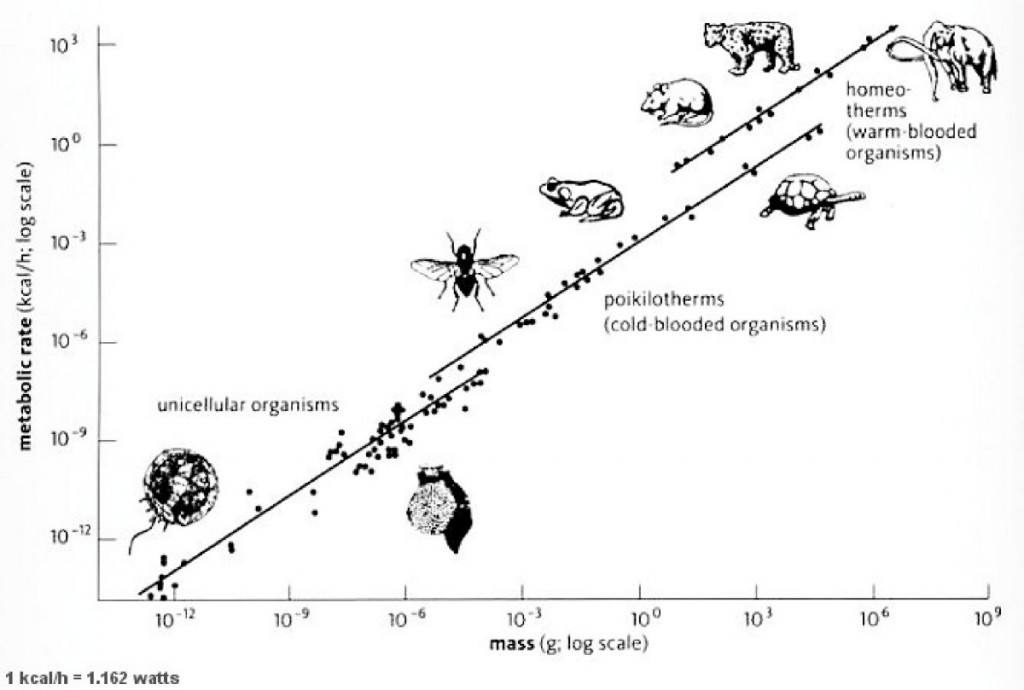

The oldest and best known Power Law is Kleiber’s law devised by the Swiss-American zoologist Max Kleiber in 1932.

Kleiber’s Law, MR = W3/4, describes the relationship of the metabolic rate (MR) to the biomass W, raised to an exponent.

Kleiber’s law means that a cat’s metabolic rate is not a hundred or 21.5 times greater than a mouse’s, but about 31.6 — 100 to the three-quarter power.

This relationship seems to hold across the animal kingdom and it has since been extended all the way down to single-celled organisms, and possibly within the cells themselves to the internal structures called mitochondria, the cellular powerplants, that turn nutrients into energy. Mitochondria have many features in common with bacteria.

The law of Kleiber is also applicable to “super-organisms” like ant colonies, Cities and Eco-Systems.

Because of Economies of Scale, larger and more complex forms of organisms need less energy for each individual cell. They grow and reproduce more slowly and they live longer.

About Fractals and Kleiber’s Law

Kleiber’s law can be explained from a general model that describes how essentialmaterials are transported through Space-Filling Fractal Networks of Branching Tubes.

Goethe was right. The leaf is a one of the fundamental structures of Nature.

The factor 3/4 (3/3+1) is a consequence of the fact that a Fractal Structure has to incorporate a not-Fractal Structure, 3-Dimensional Space.

About Bilateria

About 590 million years ago, the Central Nervous System (CNS), the Brain, appeared.

The organisms with a CNS (including the Humans), the Bilateria, are able to Act and React to a Possible Harmful Stimulus.

The CNS of the Bilateria is a result of an Increase in Competition between the Life Forms that came out of the Continuing Fusion of the Cooperative Life Forms, the Bacteria. The first step in this proces was the Tube of the Sponge.

The fundamental Bilaterian Body Shape is a Tube running from Mouth to Anus, and a second Tube called the Notochord, with an especially large Sphere at the front, called the “Brain“.

The Bilateria have Five Body Spheres (1) the Brain; (2) the Spinal Cord; (3) the Heart and Lungs; (4) the Digestive Organs and Kidneys; (5) the Bladder and Reproductive organs.

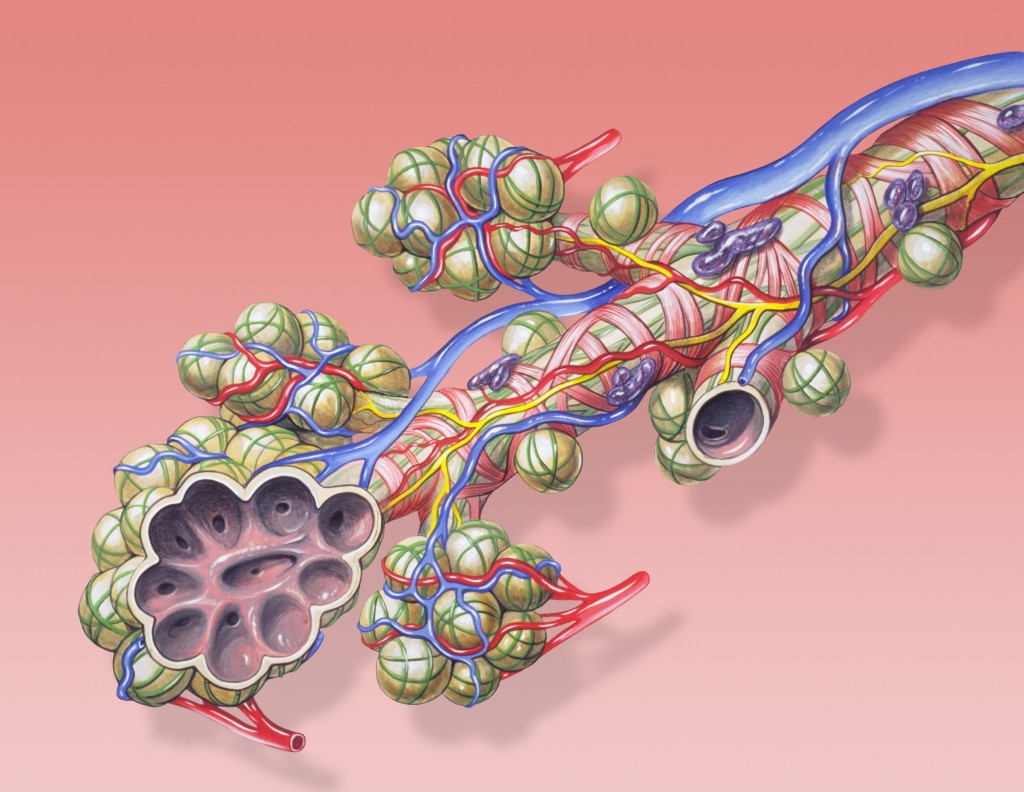

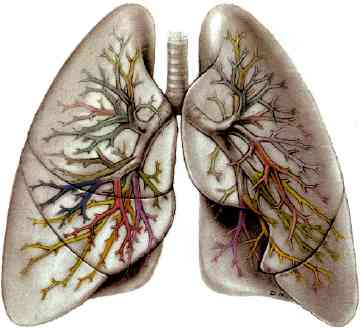

About the Tiny Spheres of the Lungs

When we look at the Lungs, one of the Fractal Tube-like branching-structures of the human organism, we can see that the Branches end in Nodes called the alveoli (“little cavities“). The end-nodes of the branching system are tiny Spheres.

The Alveoli use another basic structure of Nature: The Sphere

In the tiny Spheres the Exchange takes place of Carbon Dioxide and Oxygen between the Lungs and the Blood-Vessels. Each human lung contains about 600 million alveoli.

Water diffuses from the alveoli cells into the alveoli so that they are constantly moist. Oxygen dissolves in this water before diffusing through the cells into the blood.

The Oxygen-rich blood returns to the Heart via the pulmonary veins to be pumped back into circulation. The Carbon Dioxide is pumped out by the Lungs.

In the many million Small Spherical End-Nodes Two Circulatory Systems, the Cardiovascular System (Heart) and Pulmonary System (Lungs), are Connected.

The Big Structures of Nature are able to Scale because the Connection-Points of the Networks are Very Small.

They are reusable on Every Scale that is Bigger than the Scale of the Connection Points.

We will see that all the other Fractal Systems in our Body are based on the Same Principle.

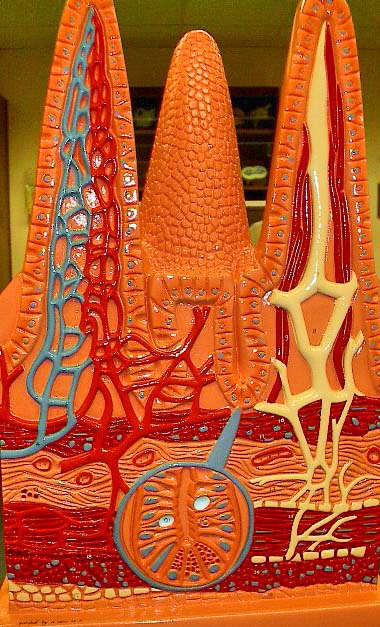

About the Tube of the Digestive System

The Tube contains the Digestive System. It breaks-down larger food molecules into smaller ones that can be absorbed into the blood stream. This happens in the Small Intestine in the vili and microvilli.

The villi (“shaggy hair“) are tiny, finger-like projections that are approximately 0.5-1mm in length. The microvilli are mechanosensors and have a lot in common with the flagellum (“the roter“) of a bacterium. Microvilli appear in many places in the body. They are also of importance on the cell surface of white blood cells, as they aid in the migration of white blood cells.

The Tube of our Digestive System is highly similar to the Tube of the Sponge, the first fusion of the Bacteria in a more efficient metabolic structure.

The Output part of the Tube is called the Large Intestine (Colon). Its function is to absorb water from the remaining indigestible food matter, and then to pass Useless Waste Material from the body. The large intestine houses over 700 species of bacteria that perform a variety of functions.

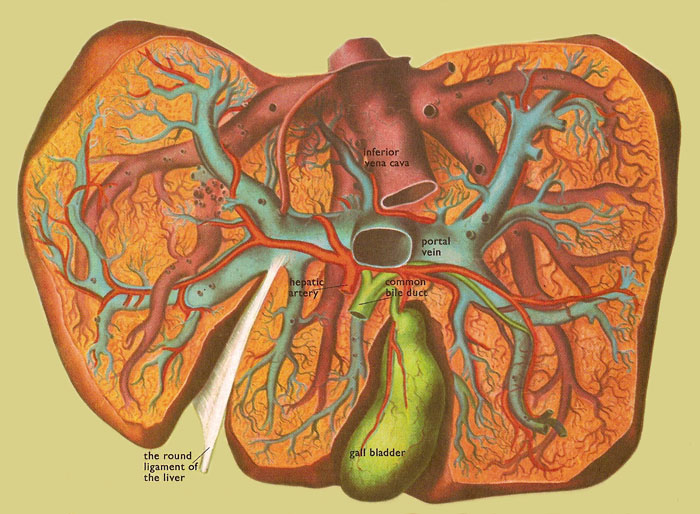

About the Chemical Factory of the Liver Cell.

The Liver is a Fractal Branching System that detoxifies harmful substances absorbed via the Small Intestines. It’s basic structure is the Liver Cell.

The Chemical reactions in the liver cells produces a lot of waste heat. This is carried round the body in the blood and warms less active regions.

The Liver regulates the amount of Blood Sugar, Lipids, Amino Acids. The Liver is the Storage House of Blood, Iron, Vitamine A, D, B12 and Clycogen, the Source of Energy of the Body.

The Liver produces Bile that is stored in the Gall Bladder. Bile is used to dissolve fat.

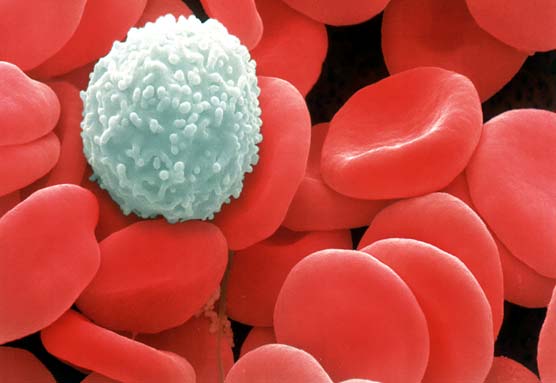

The White Blood Cell

About the Spleen and the Immune System

Another Fractal Branching System, the Lymphatic System ( “The Immune System“, Spleen), maintains the health of the body by protecting it from invasions by harmful pathogens, such as bacteria, viruses, fungi, and parasites. These pathogens are the cause of many diseases, so it is necessary to detect and eliminate them rapidly.

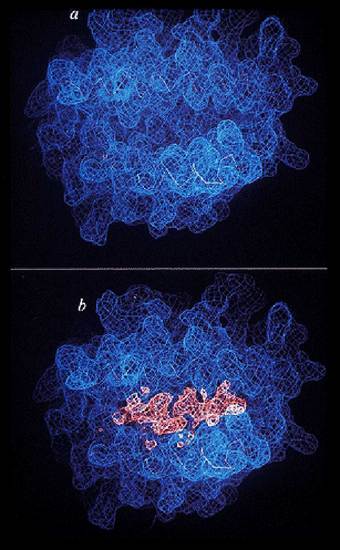

The Lymphatic System is connected to the Blood System and produces the White Blood Cells (Lymphocites). The Lymphocites are the Basic Unit of the Human Defense System. They look like Bacteria.

The surface of a lymphocyte is covered with a large number of identical receptors. Recognition and destruction occurs when the receptors of the lymphocyte fit like a key into the surface of the pathogen.

The Immune System is a Highly Adaptive System. It is able to generate new types of Lymphocites out of a Library of DNA-components.

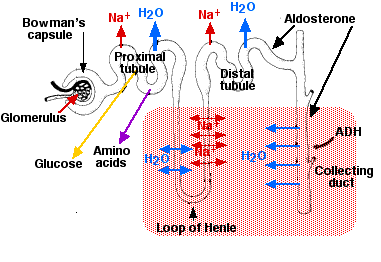

Nephron

About the Kidneys and the Bladder

The Kidneys serve the body as a natural filter of the blood, and remove wastes which are diverted to the urinary bladder. The Nephron is the basic structural and functional unit of the kidney. In humans, a normal kidney contains 800,000 to 1.5 million nephrons. Nephrons are wave-like structures. Its chief function is to regulate the concentration of water and soluble substances like sodium salts by filtering the blood.

About the Electro Magnetic System

The last Fractal Branching System, the Meridians, is a Fast Electro-Magnetic Channel that connects to Organs to the Spine and the CNS.

The Ancient Chinese Scientists believed that this System pumps its Energy, the Chi Force, out of the Earth Magnetic Field.

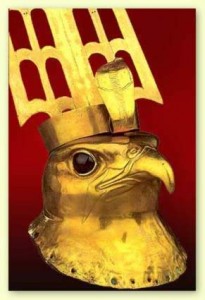

The Ancient Egyptian Scientists believed the same thing. They named the Four Cavities the Four Suns of Horus and the Spine, the Djed Pillar (Dj means “Snake”).

The Five Systems of Acupuncture

About the number Five

The number Five (4 +1 ) plays an important role in Ancient Chinese Medicine.

The Central Fractal System, the One (1), the Fire System, the Blood System, with its Center the Heart, contains Four (4) Links to the Other Systems.

The Four Systems are combinations of Two Forces, Expansion and Compression.

The Two Forces came out of One Force (“The Void“).

Two Systems contain the same combination (Expansion x Expansion (Wood, Gall Bladder, Liver, Three Heater), Compression x Compression (Metal, Lungs)).

Two Systems combine Expansion and Compression in a different order (Expansion x Compression, Compression x Expansion). They create a Wave (Water, Bladder, Kidney) or Spiral -like (Earth, Immune System) structures.

The Five Spheres of the Body are incorporated in one Super Protective Sphere, the Coelum, the Skin.

In the Human Embryo the First step of Division of the Cells is between the Coelum,the Multi-Cellar Body, and the Brain, the CNS. In the first step the One was divided into the Two, the Actor and the Monitor.

The CNS “mirrors” the activities of the Body and acts as a “predictive simulator”.

The Shape of the CNS is a mirror (Up-Side-Down) of the Shape of the Multic-Cellular Body.

The Bilateria are a Fuse of two Organisms in which one organism changed into the Body and the other changed into the Brain.

These two structures are always competing in the Human Being.

The Brain is Looking Up at the Sky. The Body is Looking Down at Mother Earth, it’s Creator.

The Brain and the Body are United in the Heart, the Balancer of Body and Soul and the Keeper of the Rhythm (The Pericardium).

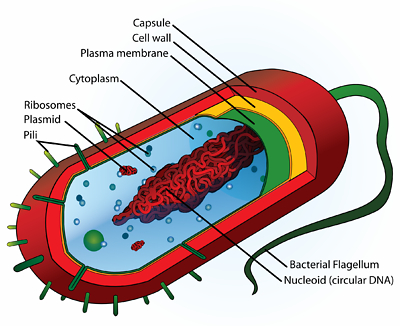

About Bacteria

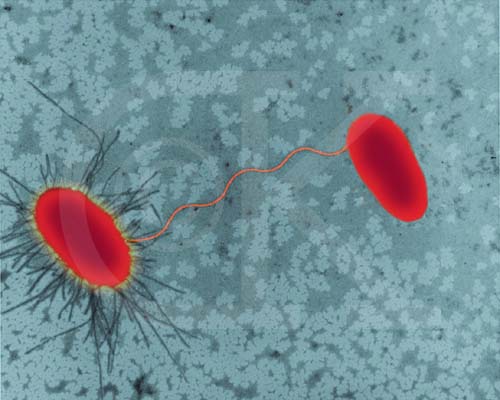

The Body Shape of the Tube was inherited from the first Multi-Cellular Organism, the Sponge. The Sponge is a Static Cluster of Amoeba, free moving bacteria, that are propelled by their flagellum (a Roter).

Bacteria are small chemical factories that are able to share and combine their production processes by exchanging DNA.

With their flagellum the Bacteria Explore the environment to find the chemical food they need. When they have found food the Circulation of the Flagellum moves into the Opposite Direction.

The bacterium integrates incoming chemical signals during a few-second period of its travels, and adjusts its direction of advance accordingly.

The integration is achieved through temporary chemical modifications to molecules located in the bounding membrane, which transfer nutrients to the cytoplasm, and also through changes to certain other molecules in the interior of the cell. Such integration is essentially a short-term memory mechanism.

At a certain moment the Bacteria got together because the Sponge is a much more Efficient Metabolic Structure than a group of Free Moving Bacteria.

Strangely enough the DNA of the Sponge already contains the complete Bleuprint of the Humans.

Scientists now believe that most species on earth are a result of a loss of DNA from the original Bleuprint that was created when the Bacteria finally fused into one Organism.

About the Nano-Level

Recently scientists have found Electric Fields as strong as 15 million volts per meter in the Nano-Parts of the Cells. These fields are as strong as those produced in lightning bolts.

It’s not clear what causes these strong fields or what they might mean but they could account for a until now unknown (by Science) or well-known (by the Old Scientists, Chi) Source of Bodily Energy.

The nano-parts of the Cell could be the very very very small universal building blocks of Nature.

What has Happened?

In the beginning the Chemical Soup generated Self-Reproducing Chemical Factories.

These Factories combined into bigger Factories by exchanging and combining their factory-designs.

Every time when the Factories fused they became more Efficient, Bigger, Stronger, Older and therefore more Competitive.

When the Factories became more competitive they had to Protect themselves against the other Factories.

To Protect themselves the Multi-Cellular Systems started to Sense in Many Directions.

In the first step a Nerve-Net was created.

In the second step one part of the Organism turned Upside-Down and became a Specialized Predictive System (the CNS).

This part fused with the Bodily Part creating one Organism that contained Two Organisms.

The Bilateria, the Organisms with Two Complementary Parts, Body and Mind, were born.

Some of the Bilateria called Humans fused in Social Structures and the Social Structures fused and fused and became more efficient, bigger, stronger, older and therefore more competitive.

In due time they will Rule the Earth and will start to create bigger and bigger systems until they will rule the complete Universe.

To make this possible the Humans need every other part of Nature to Sustain their Growth. This will certainly result in a huge Collapse of their own Eco-System.

The main reason this is happening is that the Humans forgot to Copy the Designs of Mother Nature.

The Brain (Thinking and Sensing, Left Brain), Looking Up at the Sky, believed it could do a much Better Job than it’s counterpart the Multi-Cellular Body (Emotions and Imagination, Right Brain), Looking Down at the Earth, the Source of All Creation.

Kleiber’s Law shows that we are now using 122 times more Energy per Person than we really would need if we would Scale in the right way.

What can we learn from Kleiber’s Law?

All organisms including the humans depend for their maintenance and reproduction on the close integration of numerous subunits.

These components need to be serviced in a relatively `democratic’ and efficient fashionto supply energy, remove waste and regulate activity.

Natural Selection solved this problem byevolving hierarchical fractal-like branching networks, whichdistribute Energy, Information and Materials between Big Reservoirs (“Lungs”) and Small Connection Points (“Alveoli”) of other Circulatory Systems (“Blood”).

This Fractal Bottum-Up approach is highly effective and efficient.

The not-fractal, Top-Down, machinery designed by the Humans is Scaled with a factor 1 so we can improve a lot by copying Mother Nature.

LINKS

About the Heart Chakra or Why the Heart connects the Brain and the Body

How to use the Heart to find Balance

Why Humans look a lot like Bacteria

About Kleibers Law and the Rain Forest

A movie about Fractal Structures in Nature

About the Fusion of Water in the Cell

About the Number Five in Chinese Medicine

Why Humans are part of Super Organisms

How the Humans evolved out of the Bacteria

About the Left and the Right Brain

How the Heart synchronizes the Body

About the Fast Transmisson Channel in the Body

A general model to explain Kleiber’s Law

About Kleiber’s Law and the Growth of Cities

About the Law of Kleiber and Ant Colonies

The belief in Rational Decision Making has been the focus of Economic Theory for a very long time.

The belief in Rational Decision Making has been the focus of Economic Theory for a very long time. Humans base their theory of the other on inferences about historical behavior and completely forget Situational aspects. When a context is hostile the other must be hostile too. When others behave differently from their expectations they suddenly introduce situational factors to sustain their believe system.

Humans base their theory of the other on inferences about historical behavior and completely forget Situational aspects. When a context is hostile the other must be hostile too. When others behave differently from their expectations they suddenly introduce situational factors to sustain their believe system.