Today the Dutch Government decided to take over the Dutch Activities of Fortis including ABN AMRO. The decision of the Government creates a very Different Position. The integration of Fortis (Netherlands) and ABN AMRO has turned into a takeover of Fortis by a state owned ABN AMRO. The history of Government intervention in Big Companies always shows the same pattern. It fails. The Customer is in Control and the Customer wants Security, Service and Cooperation.

The Government is paying 16.8 billion Euros which is about 1000 Euros per inhabitant. I am sure they will never recover this amount. The enormous rise of the State Debt will create Inflation. This will speed up the Recession. When the Customers of the Government, The Voters, find out what is really happening they will be furious. The big problem is that they don’t know how to show their anger. The old-fashioned party system in the Netherlands is still in control. The new parties are playing the old card of racism, religiouss fanatism and nationalism. They will find a way to put the blame of the economic crisis on the Islam.

The action of the Government was triggered by a gigantic move of customers of ABN AMRO and Fortis to other banks. The RABO-bank, the most customer-friendly bank in the Netherlands, was unable to help all the people who wanted to move from ABN AMRO and Fortis to the RABO-Bank. There is a long waiting-list.

Many people have moved their savings to accounts outside Fortis and ABN AMRO. ABN AMRO and Fortis encountered a “Run on the Bank” but in a sophisticated way. People just moved their money to a secure place.

The Government wanted to restore the Confidence in Fortis. Confidence is not the only issue in Banking. A much more important issue is Service.

The first question you have to answer is will these people come back? I don’t think so.

Many people wanted to move from ABN AMRO to another bank for a long time. They did not do this because moving to another bank is not easy. They hesitated and accepted what was happening because “the other banks are not really different from the other banks“.

When people start to move it will be almost impossible to stop them moving! If this happens, and I am sure this will happen, the market share of Fortis/ABN AMRO will decrease. I have decided to move to RABO-Bank and I will proceed. I am sure I am not the only one.

According to Nout Wellink, President of the DNB, the Dutch Regulator, the integration of Fortis Netherlands and ABN AMRO has to speed up. I don’t think he has any experience with what is means to integrate two Banks under Pressure.

Again we have to question the two issues Culture and Technical Infrastructure.

The integration of the Technical Infrastructure will be a major burden. This problem remains independent of any solution that is chosen.

The Cultural Issue has changed a lot. Now we have to look at the effect of the mix of the Culture of the Dutch Government (the Owner), the ABN AMRO-culture and the Fortis Culture. The first thing that will be very clear is that the Fortis Culture will be the big loser. They are simply small in comparison to ABN AMRO. The next thing you have to know that the Management of ABN AMRO (especially ABN) has a “lot of friends” in the Dutch Government. The “old management” of ABN AMRO (or better ABN) will take over control. At the End of the Line the Merger of Fortis and ABN AMRO will not have any effect on the culture of ABN AMRO. If this is correct ABN AMRO will not become a “customer-friendly” bank at all. It will just go on the way it was! If this is true there will be no reason to move back.

So if my analysis is right the investment of 16.8 billion Euros (remember the Dutch Government already invested already a lot of money) will generate a gigantic loss.

What is the only solution?

The lessons that has been learnt a long time ago is that when the Market is restructuring the Government has to stay out of this process.

The Market is dominated by Customers and Customers simply move to the place where they are able find Service. They are constantly searching for a place to find Rest (Balance, Harmony). They want somebody who Takes Care of Them. Nothing More.

The Dutch Government has a long history of not-listening to the Customer. Many people have lost faith in Government and the Old Parties are losing their Voters for a long Time. The old parties block the entrance of the new parties (SP, the Socialistic Party!) in Government.

I am sure someday somebody will create the Bank of the Heart. I am sure the SP and many others want to reform the old banking system and move back to the “old cooparative structures”. The RABO is one of the last cooperative structures that are left in the Netherlands! I know how to recreate a Cooperative Bank. The Nice thing is that the Current Cooperative Technology is simply made to do this. I know how do this and many others know how to do this. It is time to Act.

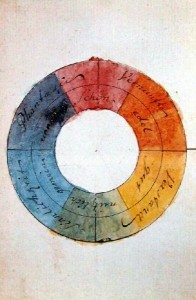

In 1999 John Gage wrote the book Color and Culture, Practice and Meaning from Antiquity to Abstraction. The book explains the way people “think/sense” about Color in History.

In 1999 John Gage wrote the book Color and Culture, Practice and Meaning from Antiquity to Abstraction. The book explains the way people “think/sense” about Color in History. A very remarkable researcher who has discovered many phenomena is the Dutch

A very remarkable researcher who has discovered many phenomena is the Dutch  Before that time Color was a Field. Colors (and Images) were created by adding Layers.

Before that time Color was a Field. Colors (and Images) were created by adding Layers. When you want to do a very simple experiment just do what Goethe did. He wrote a book called Color Theory that contains all his experiments. Goethe used the German word “

When you want to do a very simple experiment just do what Goethe did. He wrote a book called Color Theory that contains all his experiments. Goethe used the German word “