The Unemployement and the Stock Market are rising for some time now. A new Stock Market Bubble is building up and will explode in the near future. The biggest Bubble is certainly the US Deficit Bubble.

The Stock Market Bubble and the Deficit Bubble will explode as soon as the major creditors (China, India, …) of the US will move out of the Dollar. This is happening already.

The Customers are the backbone of the Economy and the Leaders understand very well that the Economy is governed by Psychology. So Bad News is hidden en Good News is exaggerated. The Expectations of Analysts are always beaten and the downfall is falling slower than before.

The Economy is still in a terrible state and this state is getting worse every day. The unemployement is still rising and will rise for a very long time because companies are getting broke or are rationalizing everything that is possible.

They replace their employees by IT-Technology and Cheap Labor. The customers are not buying, they are saving more and more money for a rainy day or are paying back their debts.

Saving money will not stimulate the economy. It stimulates unemployment. The rising unemployement results in more foreclosures and problems with credit card debts. The Economic Downturn is just at its beginning.

Economist John Williams says that– if the unemployment rate was calculated as it was during the Great Depression the unemployment figures for July 2009 rose to 20.6%. According to an article summarizing the projections of former International Monetary Fund Chief Economist and Harvard University Economics Professor Kenneth Rogoff and University of Maryland Economics Professor Carmen Reinhart,… unemployment could rise to 22% within the next 4 years or so.”

The Scenario of the Current Downturn is highly comparable with the Scenario of the Great Depression with one exception. The current Downturn is much deeper than the other. We are approaching the Biggest Global Economic Crisis in Human History.

The current investors base their policy on positive news and ignore the bad news. They believe the economy will rise when the customer-confidence is rising or when the downfall of the economy is “slowing down” or “bottoming”. They don’t see that a slowing down of a downfall is still a downfall.

The investors, the Doves, act just like the behavioral economists predict they will act. They read the headlines, believe the Hawks and are not aware of the (Money) Illusion the Government, the Media and the Banks are creating. The Hawks know better. They buy Silver, Gold and certainly the best investment, Oil.

Nouriel Roubini has a more realistic view on the economy. In his article Ten Risks to Global Growth he analyses the risks that could block the recovery of the economy and his conclusion is highly pessimistic.

According to Roubini the major cause of the crisis is overspending. Overspending is a normal activity when the Kondratiev-Cycle is in the state of Autumn. The debts are always repayed in the next phase, Winter. In the Kondratiev Winter the economy is purged and cleansed. This phase started around 2000 and will be finished around 2013. In the Winter-State you have to stay in cash or invest is Gold and Silver.

At this moment the investors don’t know what currency they have to chose for their cash-reserves. Usually the Dollar was a Save Heaven but the current policy of the FED to expand the amount of Dollars to an almost unbelievable amount is seen as a huge risk.

The Creditors (China, India, ..) of the US are already creating an alternative currency and are secretly and slowly moving out of the Dollar. If the Trust in the Dollar has gone the US Economy will go bankrupt.

The big problem with the current Cycle is that we have moved to the Level of Earth. In the last downfall of the Kondratiev Cycle other parts of the world were decoupled. They moved in a complementary mode. The Down of one part of the Earth was compensated by an Up somewhere else.

At this moment the complementary parts are synchronized and act and react according to the same rhythm. This rhythm is related to a longer term cycle that almost nobody is aware of. This cycle with a periodicity of 250 years is called the Secular Cycle.

The current level of integration of the World Economy is very dangerous. The production-processes of the Earth are highly rationalized and integrated. When one process stops the rest of the processes also has to stop.

The very high level of rationalization causes cascades or avalanches. The fast and slow avalanches generate sudden bursts of unemployment and financial disasters. The Car Industry and the Financial Industry are good examples. At this moment the avalanches start new avalanches in completely different branches of the tree of the World Economy.

The Crisis in the Banking Industry puts a large part of the Corporate Sector under severe financial stress. Firms that in the past would have been able to roll over their loans, bonds and debts now face a liquidity crisis that may lead them into costly debt restructuring.

This will affect the Banking Industry and will also put a high strain on the Bailout capacity of the Governments who are not able to leant money or inflate money until eternity.

The only solution that is left is to Rationalize even more than the Companies were planning to do. Their only solution is to speed up the use of IT (Use the Internet) and fire the employees. It is very clear that the use of IT in Companies is still in its infancy. Many manual activities can be replaced by software. The total effect will be a worsening of the current crisis.

To stop the cascades governments are starting to Protect and Regulate their Economies. The Worldwide Cooperative Institutions are losing their grip and the Free Market Economy is on its return.

Big Companies are splitted according to the old Boundaries of Power. The expansion and integration of the EG is blocked because the member states suddenly have conflicting objectives. The Rich Countries don’t want to help the Poor Countries because the Rich Countries are getting poorer with the minute.

Not only the poor member states of the EG are getting into big trouble. The same applies to the Underdeveloped Countries. The poor Countries of the World are on their own. Everybody is in the Survival mode and The Fittest, The Rich, will as always Survive.

The world is not only hit by a Economic and a Cultural crisis. The world is also hit by a Climate Crisis. Although human activity plays an important (negative) role the Cycle of the Climate related to the activities of our Sun and the Movement of Earth in our System (the Precession Cycle) is much more important.

The current change in Climate is irreversible and will have a major effect on the world economy. Climate change and ecological misuse are the major factor why Societies collapse.

The last factor and perhaps most important factor is the Energy Consumption of the World. This consumption is not only affecting the Climate but it also facilitates a huge highly integrated Transport-System.

This System is the Backbone of the Integrated Value-Chains of the Western World. The Western World is completely dependent on the transport system for its Industrial Production and the Supply of Food.

The Transport System has a devastating effect on the poor countries in the World. To make enough money to survive they have to export their products to the Western Markets ignoring their own needs.

It is certain that the supply of oil and gas is lower than the increasing demand. The resources all over the world are going down. The total effect of this all will be a dramatic rise in price. This will affect the rich countries and in particular the US. They are already the major importer of energy in the World and when you import something you have to export something else to keep the financial balance in order.

As you already know the deficit of the US is spectacular and the only reason the US is not broke is the special role of the Dollar. If the economy recovers the demand and the prices will rise and the US Economy will slow down immediately.

What is Going to Happen?

Every scenario leads to a long term decline of the Economy, our Culture and our Civilization. The theory of the short term and long term cycles is right and it is very stupid to ignore these theories.

According to the Panarchy Model the world is too connected and this leads to an increasing rigidity in its goal to retain its state. The rigidity reduces resilience and the capacity of the system to absorb change, thus increasing the threat of abrupt change. The world is unable to cope with the changes of climate and culture that are happening now. Therefore we will see the collapse of the accumulated connections and the destruction of bound up knowledge and capital.

The highly integrated structures of the Earth (the Cooperative Institutions, the Big Companies, Governments AND the Transport System) are bound to desintegrate. The impact on the local structures is immens. Communities will have to grow their own food, manufacture and repair their own tools, create their own currency etc etc on a local level again.

Most of these structures have outsourced these functions to places far away and don’t have the skills nor the resources to do this. The fittest, the Haws, will survive but it is unclear if the Doves will accept this situation forever. A Rise of the Masses just like the French Revolution in 1789 (almost 250 years ago!) is possible.

The world is moving to a very fast transformation. The only thing that can be said when we use the Panarchy Model is that it will move back to a stable state before the expansion started and start all over again. The Wisdom of the Old Civilizations that survived earlier Collapses is very valuable. These lessons are very easy to comprehend.

Civilizations die because the humans don’t want to Move with the Cycles, don’t Cooperate and don’t Respect Mother Nature. When Civilizations Collaps even the Hawks lose Everything!

LINKS

Peter Schiff, Why the US Economy will Collaps this Year

How the Fed is cheating the citizins. About Deflation.

Why the Labormarket is Much Worse than we Think

Why the Current Crisis is comparable with the Great Depression

About Behavioral Economics, Why Hawks always Win and Doves always Lose

Nouriel Roubini, Ten Risks to Global Growth

About The Kondratiev Winter and the Generations Theory

About the End of the US Dollar

Why the US Defense Budget will Destroy the US Economy

Peter Turchin, About Secular Cycles

The Complete Text of the Book of Turchin

About the Problems the Real Estate Market is Facing

Why Rationalization is the cause of the current Crisis

Jared Diamond, Why Societies Collapse

Jeff Rubin, Why Your World Is About to Get a Whole Lot Smaller

About Peak Oil, The Model that Predicts the End of Oil and Gas

I have been involved with mental illness all my life.In my fathers family many people were mentally ill.

I have been involved with mental illness all my life.In my fathers family many people were mentally ill. A specialist uses a questionnaire and out of the test comes a mental-illness-term, a procedure and medication how to treat the illness. Mental illness is standardized like many other areas in our society.

A specialist uses a questionnaire and out of the test comes a mental-illness-term, a procedure and medication how to treat the illness. Mental illness is standardized like many other areas in our society. To put it in other words The System itself is mentally ill and according to its own terminology it is Paranoid. To cure the System we have to find out what helps a Paranoid to become “Normal” again.

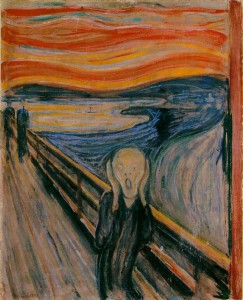

To put it in other words The System itself is mentally ill and according to its own terminology it is Paranoid. To cure the System we have to find out what helps a Paranoid to become “Normal” again. Insane is a state where all structure is gone. Insane is the ultimate state of Chaos. Insane is the state where the Conscious is gone and the Darkness of the Unconscious rules.

Insane is a state where all structure is gone. Insane is the ultimate state of Chaos. Insane is the state where the Conscious is gone and the Darkness of the Unconscious rules. At this moment we are in the downfall of the factory-model that is striving to make everything the same. It is aimed at Equality.

At this moment we are in the downfall of the factory-model that is striving to make everything the same. It is aimed at Equality.