“Evolution means the creation of larger and larger islands of order at the expense of even greater seas of disorder in the world. In the process of evolution, each succeeding species is more complex and thus better equipped as a transformer of available energy.: Jeremy Rifkin, Entropy: A New World View (1980).

You wouldn’t enjoy a perfectly ordered universe. A wholly ordered universe would be at perfect equilibrium and would be dead. There can arise no Order unless there is a Flow of Matter and Energy which decreases in intensity as a system moves toward equilibrium. Motion, change or evolution in the Universe is driven by fluxes of energy and energy-rich matter flowing from sources of high potential to sinks of lower potential.

During the road from Being to Becoming Cyclic Auto-Catalytic Systems are created that Re-Create themselves until they Die. Islands of Order Appear and Disappear in the Sea of Chaos.

About Thermodynamics

Thermodynamics is the Science of the Transfer of Energy.

In strict Scientific terms Energy is classified into two main forms: Kinetic and Potential energy. Kinetic Energy is defined as the energy of a moving object. Potential Energy is defined as the energy in matter due to its position or the arrangement of its parts. The various forms of Potential Energy include gravitational potential energy, elastic potential energy, chemical potential energy, and electrical potential energy.

The First Law of Thermodynamics says that the total quantity of Energy in the universe remains Constant.

The Second Law of Thermodynamics states that the quality of this energy is degraded irreversibly. The Second Law predicts that our Universe will end when the Explosive Motion of the Big Bang wil stop and we will reach the Absolute Zero.

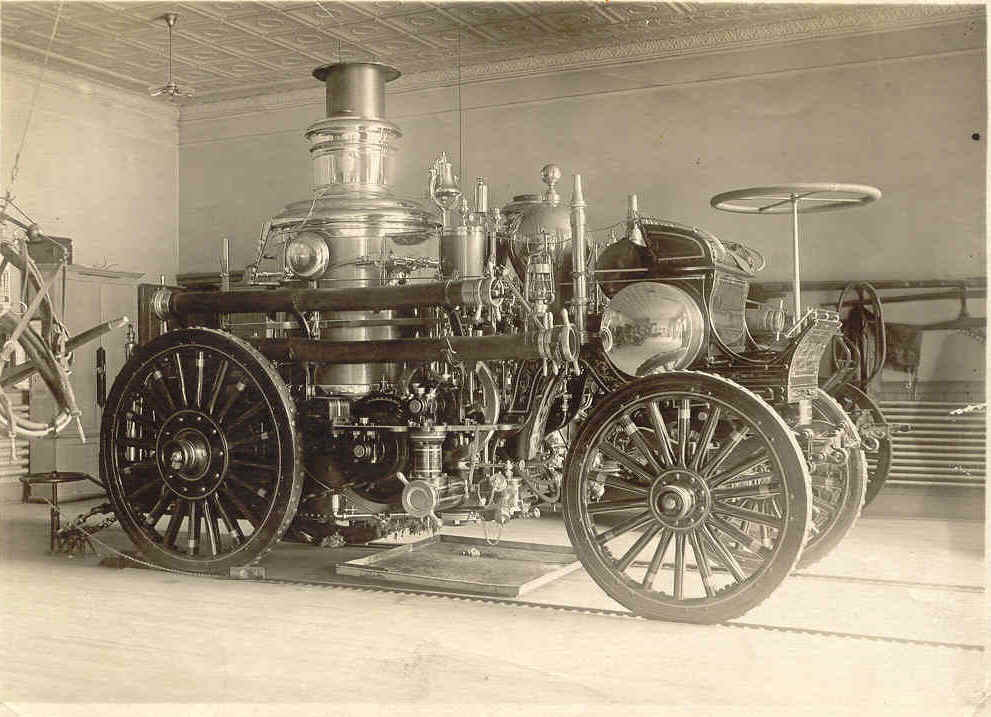

Nicolas Léonard Sadi Carnot (1790-1832) detected the Second Law of Thermodynamics when he tried to find the most efficient heating engine.

According to Carnot the Efficiency of an Engine is (T1−T2)⁄T1, where T1 is the highest temparature. The Higher the Difference between the two Temperatures of the Engine the Lower the Efficiency. The Bigger the Step the Higher the Waste. If you want to build a highly efficient Engine, the Engine has to make very Small Steps when the Engine is heated. This principle is known as Adiabatic Expansion (and Compression).

Physical, Chemical, and Electrical energy can be completely changed into Heat. But the Reverse (heat into physical energy, for example) cannot be accomplished without a loss. The irreversible increase of this nondisposable, useless, energy in the universe is measured by the abstract dimension called Entropy (from the Greek entrope, change).

The Entropy measures the degree to which the probability of the system is spread out over different possible states. If all the possible States of the System are the Same, the System is in Equilibrium and the Entropy, the State of Order, is on its Maximum.

In the Beginning of the Universe Every Thing was Different. In the End State Every Part of the Universe will be the Same.

About the History of Innovation

The central actor in the 19th century model of cultural innovation is the Artist, conceived, as an individual creator of works of art. Art is produced only by a handful of exceptional individuals.

The process of technical innovation in the 19th century was seen in terms similar. The central focus was on the work of individual inventors and researchers, commonly with little or no specifically scientific training.

By the early 20th century, this model was displaced by an industrialized process of innovation.

The first major step in this process was the rise of the Research University and the development of a large class of technically trained workers. In the 20th century, pure scientific research had become the preserve of universities and specialist research institutes.

The second major step was the development of corporate forms of business organization, which allowed Research and Development to become an organized business activity, operated on industrial lines.

The pattern of innovation in the 21st century is radically different. In most sectors of the economy, the rate of technological progress has slowed down substantially. Technological progress is characterised largely by Incremental Improvements to mature products.

In Computing and Telecommunications, the rate of progress has accelerated dramatically since the late 1980. The convergence of Computing and Telecommunications in the Internet has fundamentally transformed every activity it has touched. Everything that can be formalized will be formalized.

The Internet makes it possible that disjunct Networks of Isolated Innovators connect and share their Knowledge and Experience.

The Artist, now connected with many other “exceptional individuals” all over the world, is on its return.

About Incremental and Disruptive Industrial Innovation

There are two types of Industrial Innovation called “incremental” and “disruptive” innovation.

Japan (and now China) has made incremental improvement the cornerstone of Technical Advancement. After months and years of gradual (adiabatic) changes, products look radically different, as happened with semiconductors, solar cells and batteries.

The US claims that it is the Champion of Disruptive Innovation. Their “Internet”-entrepeneurs like Amazon, Google and Facebook believe in a “Statistical” model of Innovation, A Portfolio or an Innovation Ecology.

One of the many “Trials and Errors” will result in a big breakthrough that will Disrupt the Market. Behind Disruptive Innovation lies the Concept of Evolution, Survival of the Fittest, the Essence of Capitalism.

Disruptive Innovation uses Incremental Innovation to improve the Parts of the Portfolio.

Incremental Innovation (“Proces/Product/Business Model Improvement”) takes place when an Innovation is improved until the Limits are reached.

Incremental Innovation could use the Efficient Small Steps of the Adiabatic Process to reach the Goal of the highly Effective.

Most of the time Proces/Product Improvement (“Standardization”) is not a Structured Process because People believe Innovation is about “Thinking Out of the Box”. If People “Think out of the Box” the proces will move into a Chaotic State and will Die.

Creative Incremental Innovation will produce a Lot of Waste (“Heat”, “Fuzz”) and accomplish Nothing. Managed Incremental Innovation has to remove the Waste and the Constraints.

With every step that is taken the System has to become more probable so the results of the proces will be more predictable. When the Limits are reached, we have to Restucture the System to move on.

The Second Law of Thermodynamics shows that Closed Systems finally Converge to a State of Equillibrium with a High Probability, a High Entropy.

Systems that are Isolated by a Boundary behave as Closed Systems. Systems that are Open to other Systems Merge and become Closed.

Most of the Time people don’t understand the Boundary of their System and Act in a Shared Boundary. In this Shared Boundary Competition takes place. Competition is a waste of Energy. If People could define their Boundaries they could Cooperate.

People Communicate. They Share their Ideas, Problems and Solutions. When a Process is well understood the Improvements of the Process are disseminated through the Human Networks and widely Copied.

Human Networks are Closed Systems that are connected to other Networks by Boundary Spanners.

Most people don’t understand that there are other people in other Networks who are doing the Same thing they are doing. They think their activity is Unique and don’t understand that the State of Uniqueness was only there at the Beginning.

Secrecy slows down communication between the People in the Network. The result of Secrecy is that People are unable to learn from others so they are unable to reuse the solutions of others. Secrecy is again a Waste of Time.

In the end the Competitive Advantage of the Innovation is completely gone and the Entropy of the System is at its Maximum.

At that moment every Process in every Part of the System will be the Same and the Companies will Merge or will be taken over by other Companies. Winner Takes All.

The Temperature of the Industry will move to Zero and every Movement (and Innovation) will stop.

About Creativity

There are two Views on Creativity. Creativity is a Combinatorical Game and Creativity is a Spontaneous Eruption of Ideas forced by High Pressure.

At such a moment, “the Aha-Erlebnis“, two or more Frames of Reference Fuse and a new Innovative Combination is created.

The last view has a lot to do with the theory of “Self-Organized Criticallity“.

The Metaphor of this Theory is the Disaster, the Avalanche or the Sand Pile that Suddenly moves when the critical grain of sand falls. At that moment a Significant Part of the Collection of individual grains Combines and moves on its own.

When a System is reaching the Boundaries of Proces Improvement and a Huge Pressure to Innovate is experienced, two or more Systems (“Frames of Reference”) Fuse (Combine).

When the Systems are in Equilibrium the Fusion is easy (“Connecting”) otherwise the Fusion could become a Disaster, a Disruption, a Creative Destruction and a Huge Amount of Heat (Waste) is produced.

About Managed Creativity

If Innovation is a Combinatorial Game we have to restructure a System into a “loosely-coupled” System of Components and combine the Components with the “well-articulated” Components of other Systems.

A Loosely Coupled System is a System where each of its components has, or makes use of, little or no knowledge of the definitions of other separate components. The components act as “Black-Boxes“.

A Component is “well-articulated” if it contains Just Enough Functionality to do the job. An Under-Articulated system is Rigid. It contains Not Enough functionality to Adapt to the Changing environment. When Systems grow old they become Over-Articulated because the Designers want to add new functionality without looking at the Boundaries of the System. Over-Articulated Systems overlap and it becomes very difficult to find the Essence. Designers always want to Solve every problem with their Own System.

Genrich S. Altshuller was a Russian Patent Officer who tried to find a Pattern behind Patents.

Altshuller screened over 200,000 patents looking for Inventive problems and how they were solved. Of these only 40,000 (20%) had somewhat Inventive solutions; the rest were straight forward improvements.

Altshuller defined an Inventive problem as one in which the solution causes another problem, a Contra-Diction or Conflict, to appear. He found that the same problems had been solved over and over again using one of only Forty fundamental inventive principles. Altshuller named his method TRIZ.

Humans are prone to reivent the Wheel many times because they only look for Solutions in their own Frame of Reference. The Solution of their Problem is almost all the time already available in another Domain.

Roni Horowitz has analyzed the Principles of Althuller and found a deeper structure behind TRIZ which he called ASIT.

ASIT is about Thinking Inside the Box instead of Outside the Box. The so called Closed World condition, forces the thinker to find a creative solution by heavily limiting his or hers Space of Possibilities.

The Qualitative Change Principle looks for solutions in which the influence of the main problem factor is either totally eliminated or even reversed. The System has to become Perfect. Every Component has to fullfill just one Task (“Well Articulated”) and the Functions of the System have to create a “Closed World” which means that the System has to be Closed in Itself.

About Combining the Combinations

The Second Law of Thermodynamics shows that it is Almost Impossible to move back to an old solution when the Solution is widely used.

Nature Solves its Problems by Experimenting but the Experiments are not completely at Random. Nature uses an Established Infrastructure and Plays with all the Possible Paths that Emerge out of the Existing Infrastructure, The Adjacent Possible.

Before life emerged on Earth, the planet was dominated by a handful of basic molecules. Each of these molecules was capable of a finite series of transformations and exchanges with other molecules in the primordial soup.

According to Stuart Kauffman Life started when the Chemical Parts of early life started to Re-Create themselves in a Cyclic Process called AutoCatalysis. Re-Creation of the Same Structure is one of the most important principles of a Living System. Our body is recreated all the time in an endless Cycle until we Die.

If you could Play with all the Primordial Combinations, you would end up with the Components of Life but it is impossible to create a mosquito, or a sunflower, or a human brain.They were created when the Combinations started to Combine Again and Again.

Innovation in Nature is an endless Cyclic Expanding proces of Combining the Combinations.

This process moves on until the Limits of the Expanding Space of Possibilities are reached. These Limits are reached when there is not enough “useful” Energy available.

Combining the Combination happens in Nature but also in our Culture. Old infrastructures are used in a new way and a complete new field of Combinatorics appears.

Johannes Gutenberg took the older technology of the screw press, designed originally for making wine, and reconfigured it with metal type to invent the printing press which made it possible that new ideas, concepts and procedures were better dissiminated through the Human Networks.

Is there an End to Human Innovation?

The Universe is Expanding and is Creating New Combinations of Combinations all the Time.

The Law of Kleiber shows that the Combinations of the Combinations Fuse. The Law of Kleiber is just like Self-Organized Criticallity represented by a Power-Law. Power-Laws are independent of a Scale and therefore applicable on every Level of the Universe. They show that One Principle (“a Fractal“) Repeats itself on every Level.

Every time when the Combinations Fuse they are better equipped as a Transformer of Available Energy but the Creation of larger and larger islands of Order happens at the Expense of even greater seas of Disorder. Humanity is Wasting resources at an increasing rate, and that will lead to the destruction of our civilization.

The Combinations become Bigger and Bigger AND the Big Structures Attract Each Other. The larger group of possibilities will always be the Dominant Attractor.

This is the main reason for the success of Google, Facebook and Twitter. They have aquired the Power to Control their Market by Giving away their Products for Free so the Amount of Users would grow Exponentionally. They make money by letting other companies pay for the Use of their Huge Attractor.

The Small Auto-Katalytic Chemical Factories, the Bacteria, that were created in the beginning are now fusing into Very Big Cities and the next Step will be One Mega-City covering a Huge Area of the Earth. These Mega-Cities will be extremely Efficient and Effective. When this happens Nature will be replaced by a Human Made Technological Structure that has to use completely new ways to produce and use energy.

The next Step is easy to imagine. The Human Race will start to create new Mega-Cities on other Planets that will fuse into Mega-Planets.

The Big Problem will of course be Energy. We have to find new Sources all the time to support the Human Need to Expand and Discover. Every time when we create a new and Bigger Source of Energy the Amount of useless Heat will increase and the End of the Universe will get closer and closer.

Human Invention is Speeding Up the End because in the End Humans want to become One with the Whole.

According to the Second Law of Thermodynamics the Universe is moving to an Equilibrium State and not to an Extremely Impossible Innovative Configuration. At a Certain Point of Time Human Innovation has to Stop because we will reach the State of Absolute Zero Temperature and every Movement will Stop.

In the End the Universe will move into a State of Infinite Sleep.

What to Do?

The most important thing you can do when you want to Innovate is to create a Deep Understanding of just One Frame of Reference.

You have to become an Expert in Something and you have to have the attitude to create the Perfect Frame of Reference.

Every time when the System is not performing you have to solve the problem Inside the Box but you have to make use of Solutions that are Outside the Box.

Every Time when you are Satisfied, remove a Constraint and Force Yourself to Solve the problem.

At a Certain Moment your Frame of Reference will Explode and will produce many Fragments. They are the Basic Building Blocks of Your Domain.

Start to Play with the Building Blocks and new Possibilities will appear that you have never Thought off.

You now have entered the Adjacent Possible.

LINKS

Why Neural Networks look like the Universe

About Creativity and High Pressure

About Self-Organized Criticallity

About Self-Organized Criticallity and Innovation

About Complexity Theory and Innovation

Stuart Kaufmann about Radical Emergence

About ASIT (Advanced Systematic Inventive Thinking)

About the Origin of Good Ideas