The belief in Rational Decision Making has been the focus of Economic Theory for a very long time.

The belief in Rational Decision Making has been the focus of Economic Theory for a very long time.

Although everybody knew that Humans are Highly Impulsive and Emotional, Economists based their theoretical models of the Market on a Rational Human Being who is always able to Calculate the best Alternative possible. This Theory is wrong. The Economic Behavior is controlled by the Emotions.

The current economic crisis shows that the old Rational Theory is not applicable and the attention for alternative theories of Economic Behavior is rising. These theories are called Behavioral Economics.

An important paper in the development of behavioral economics was written by Kahneman and Tversky in 1979 (Prospect Theory, Analysis of Decision Under Risk). Kahneman was awarded the 2002 Nobel Prize in Economics for his research in Prospect Theory.

According to Prospect Theory, Humans attach much greater weight to future losses than to future gains related to their personal reference point. When you expect a certain gain in the future and this gain is lower than you expect the gain is experienced as a loss.

Kahmeman and Tversky became the experts on Cognitive Bias. A Bias is a “not-rational” mostly fast response to a stressful situation. In this case the Human System uses old structures (The Reptile Brain) that were created a very long time ago when the human lived in a completely different environment. The Reptile Brain uses many shortcuts to save time.

Social and cognitive psychologists have identified a number of predictable errors in the ways that humans judge situations and evaluate risks. Biases have been documented both in the laboratory and in the real world. For example, people are prone to exaggerating their strengths: About 80 percent of us believe that our driving skills are better than average.

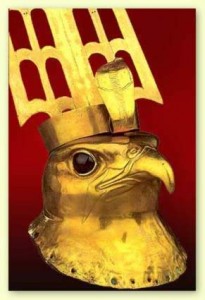

In 2009 Kahneman and Renshon wrote a paper called Hawkish Biases. It is an attempt to unite the many Cognitive Biases into one Model. The model shows that Humans are highly Confused Predators (Hawks).

As a Predator they protect their Territory with every means possible. They are Confused because they are capable to Observe and Reason about their own behavior and the behavior of others.

Humans need the “Illusion of Control” to sustain their own Identity. Every time something happens they are looking for reasons to believe that they are the Primary Actor in their own context. They don’t want to believe that Other Human Beings are also Active Agents.

If they would believe this was the case their “Unrealistic Optimism” could change into “Realistic Pessimism”. Unrealistic Optimism makes managers, politicians and generals receptive to advisors who offer highly favorable estimates of the outcomes. Such a predisposition, often shared by leaders on both sides of a conflict, is likely to produce a disaster.

When a Human is Depressed by Realism he Loses his Face and moves down in the Picking Order of the Territory.

Humans believe that every other Human is always capable to see their Weaknesses (“the Illusion of Transparency“) just like they are convinced that the intentions of others are always clear to them (“the Fundamental Attribution Error“). To hide their Weaknesses they have to wear a Mask and Play the Strong Leader of the Pack. They have to Keep Up their Appearances.

Humans base their theory of the other on inferences about historical behavior and completely forget Situational aspects. When a context is hostile the other must be hostile too. When others behave differently from their expectations they suddenly introduce situational factors to sustain their believe system.

Humans base their theory of the other on inferences about historical behavior and completely forget Situational aspects. When a context is hostile the other must be hostile too. When others behave differently from their expectations they suddenly introduce situational factors to sustain their believe system.

Humans need to sustain their believe-system because this system is the foundation of their personality. Their view on the World has to stay constant because when it changes too fast they will get into big psychological problems. When people get older their believe-system becomes very rigid.

Humans value their own possessions much higher as the possessions of others (“The Endowment Effect”). They even consider possible, imaginary, possessions as real possessions if they are convinced there is an easy way to get them.

If they lose a real or imaginary possession they take tremendous risks to get their possessions back (“Risk Seeking in Losses“). People in general don’t like cutting their losses. They’re willing to gamble on in the hope of recovering them.

Humans simply believe that a Hawk always wins the Game and a Dove always loses. What Humans (want to) forget is that they are living in a group and their In-Group and the many Out-Groups contains many Hawks. They need the confidence that they are “the best” to Survive.

The world of the Human Hawk is a world of Competition (Winner takes all) and therefore highly Stressful. The Sad Thing is that the many faces of Stress are the Major Cause of the Cognitive Bias. When Humans relax and reflect they are much more capable to solve a complicated conflict.

The competitive Hawks always fall in the trap of the Prisoners Dilemma and don’t realize that Cooperation, the Win-Win is the only Certain Way to Leave the Prison.

At this moment another Behavioral Economist, Robert Shiller, is getting a lot of attention. Together with the Economic Nobel Prize Winner George Akerlof he wrote the book “Animal Spirits“.

In the book they identify five distinct elements that blur the theory of the Rational Economy. These elements or “animal spirits” are called: confidence, fairness, corruption; money illusion and the reliance on “stories”of others.

The first three have a lot to do with the “hawk“-theory of Kahneman. The Hawks use the Rational System for their own benifit. They Play with the Rules and invent new exiting possibilities to win more than they ever could imagine.

Sometimes they Play Dirty Games to beat their Opponents. The Doves believe the Economic (Rational) Fairy Tales of the Hawks and are unable to understand the Real Value of their Money.

The Money Illusion is caused by Inflation. Inflation happens when prices Rise but the value of the objects that are priced stays the same. Inflation give people the feeling that they are making money but in reality they are losing money.

The Hawks use Inflation to keep the Doves Buying and Investing. They also use the weapon of Inflation to win the war with the other Hawks.

The Majority of the Human Beings are Doves. They believe the Hawks or are afraid of the Hawks. The Doves are the Workers in the Economy and they make it possible for the Hawks to Hunt.

The Hawks provide the Workers with many things to live an easy life until other Hawks start to Attack the Territory. In this case the Hawks need the Workers to fight and win the War.

Sometimes even the Hawks lose their Rational Capacity. They see a Big Win and become Greedy and Vulnerable. If this happens the Territory is open for other Hawks (The Chinese?) to enter and to take over without any problem.

What has Happened?

The Economic System is just like the Weather System a Cyclic System. When the Economic Cycles and the Weather Systems move UP the Hawks have an Easy Time. Their is enough food for all the Hawks. When the System is going Down Competition starts.

The Hawks forgot to look at the patterns. They did not see or believe that the downfall was approaching. They did not take enough stock to survive the Seven Bad Years. Suddenly the Autumn turned into Winter.

At this moment they are regrouping to create a Powerfull Alliance to take from the other Hawks what they need. They don’t care about the Doves. They always believe the Tales they Tell.

They are afraid of the Other Hawks that are outside their Huge Territory and are Prepared to Fight the Wars that are needed. The Doves will believe them as usual.

LINKS

About Prospect Theory and Conflict Resolution

About Economic Cycles

Kahneman/Renshon, Hawkish Biases, 2009

A Very Long List of Cognitive Biases

About the Prisoner Dilemma in Foreign Policy

An Abstract of the Book Animal Spirits

How the Chinese Networks are Conquering the World

A Review of the book Animal Spirits: How Human Psychology Drives the Economy, and Why It Matters for Global Capitalism by George A. Akerlof and Robert J. Shiller by Benjamin Friedman